Recent Posts

NYC Congestion Pricing Closer To Reality With Biden Admin Seeking Less Rigorous Environmental Review

March 30, 2021 – The Biden Administration, via the U.S. Department of Transportation, requested the Metropolitan Transit Authority (MTA) submits…

Puerto Rico Statehood Is Credit Positive Due To Medicaid, But Commonwealth May Lose Triple Tax Exemption

November 5, 2020 – Puerto Rico voters appear to have voted in favor of statehood by a 52-48% margin (votes…

NY’s MTA May Be Fiscally Stressed, But State and City Support (and a Blue Congress?) Provide Buffer.

October 6, 2020 – In a report released on Friday, JP Morgan analysts said a bankruptcy scenario is unlikely for…

Morgan Stanley U-Turns: No Longer Thinks Federal Stimulus Will Come in 2020. “Bumpy Path” for Munis Over Short-Term.

September 25, 2020 – In a reversal from its July prediction, Morgan Stanley’s municipal research team now thinks federal stimulus…

Rising Sea Levels Pose Credit Risks for Coastal States. Florida May Be Particularly Vulnerable.

September 20, 2021 – In a report issued on Sept 17, Moody’s Investor Service wrote rising sea levels would pose…

Morgan Stanley: Fed Likely To Succeed In Spurring U.S. Inflation. Investors Say Municipal Bond Yields Have Risen As A Result.

September 14, 2020 – Morgan Stanley said the Federal Reserve’s recently-announced inflation-targeting framework will likely spur U.S. inflation. The so-called…

JPMorgan: Economy In “K-Shape” Recovery. Odds of Trump Winning Increasing As Protests Simmer.

September 1, 2020 – In a research note released yesterday, J.P. Morgan analysts Marko Kolanovic and Bram Kaplan postulated that…

NYC Prices $1.4B GO Transaction. First Post-COVID Sale Locks In $240 Million In Savings.

August 27, 2020 – New York City priced its first General Obligation transaction since the onset of COVID-19. Based on…

New York City’s TFA Refinances Debt, Locks In Over $370 Million of Debt Service Savings

August 20, 2020 – In a press release released by the Mayor’s Office of Management and Budget, Comptroller Scott Stringer…

Moody’s: Schools Reopening Is Credit Positive for New York State, City and MTA. But Gains Could Be “Short-Lived”.

August 20, 2020 – In a note issued last week, Moody’s Investor Service opined that reopened schools would be credit…

S&P: Wells Fargo CEO Was Highest Paid in 2019

August 11, 2020 – A report by S&P said Charles Scharf, CEO of Wells Fargo, was the highest paid banking…

Bank of America Says Trump Executive Orders May Have Limited Economic Impact

August 10, 2020 – In a research report issued by Bank of America’s Global Economics Team, analysts noted that the…

NYC Selects Underwriters. Wells Is In. Goldman and Morgan Stanley Are Out. Minority Firms Achieve 33% of Book-Running Roles.

August 7, 2020 – New York City announced results of its recent procurement process this morning – selecting underwriting firms…

S&P: Prolonged Revenue Weakness Could Pressure Convention Center Credit Ratings

July 27, 2020 – As reopenings in California and Sun Belt states are halted, S&P Global Ratings said today it…

Foreign Investors Can Achieve Over 120 Bps Incremental Yield For Taxable Munis

July 21, 2020 – An analysis by Bank of America indicated European and many Asian investors can achieve significant incremental…

Morgan Stanley: “CARES 2” Will Extend Up To $614B of Muni-Related Stimulus Aid And Bring Back Advance Refundings

July 20, 2020 – Morgan Stanley waded into the Congressional prediction sweepstakes today, predicting that Congress will extend up to…

Low-Risk Taxable Munis Outperformed Agency and Corporate IG Debt in 1H2020

July 8, 2020 – Data by JP Morgan and Bloomberg found that taxable municipal bonds returned 8.5% in the first…

Will Charges of Racism Derail Morgan Stanley and Wells Fargo’s Muni Underwriting?

July 8, 2020 – As 2020 move into its pivotal second half, investment bankers are gearing up for a slew…

Citi’s Controversial Recommendation: Issuers Should Issue More Debt

June 28, 2020 – In a report issued yesterday, Citi’s Municipal Research team recommended state and local governments undertook “aggressive…

Betting Markets Point To 28% Probability of Democratic “Blue Wave”. Analysts: That’s Great for Munis!

June 15, 2020 – Based on betting market odds, research house Morgan Stanley computed a 28% probability (as of June…

Amid $61 Billion of Projected Revenue Declines, the Empire State Preps $3.5 Billion Cashflow Borrowing

June 9, 2020 – New York State kicked off pre-marketing today for a $3.4 billion Revenue Anticipation Notes (RANs), issued…

Opinion: New York’s Large Bond Issuers Must Do More To Elevate Black-Owned Public Finance Firms

June 5, 2020 – All things considered, the $4 trillion U.S. municipal bond market has been welcoming of Black-owned public…

Fed Expands Municipal Liquidity Facility (MLF); New York’s MTA Seen As Notable Beneficiary

June 3, 2020 – The Federal Reserve Board announced an expansion in the number and type of entities eligible to…

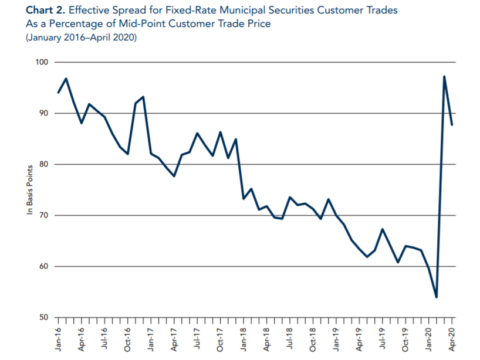

COVID-19 Dislocations Widened Municipal Bond Effective Speads By ~50 bps

May 28, 2020 – Based on a recent report issued by the Municipal Securities Rulemaking Board (MSRB), the average effective…

Were U.S. Lockdowns For Nothing? J.P. Morgan Suggests The Answer May Be “Yes”.

May 21, 2020 – In a report issued yesterday, J.P. Morgan suggested lockdown policies in the U.S. may not have…

Dem-Sponsored “HEROES” Act Would Favor California, Not So Much New York.

May 20, 2020 – The Democratic-controlled House of Representatives passed the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act…

Federal Reserve Releases “Notice of Interest” for Municipal Liquidity Facility Borrowers

May 15, 2020 – The Federal Reserve Bank of New York (“FRNY”) has released a Notice of Interest (NOI) for eligible…

NYC’s Personal Income Tax-Backed Bonds Receive Warm Investor Reception; Oversubscribed by 11x

May 13, 2020 – New York City’s premier credit – the AAA-rated Transitional Finance Authority (TFA) – received a warm…

Fed Municipal Liquidity Facility (MLF) Pricing Revealed. Likely To Provide Life Line for COVID19-Impacted Municipalities.

May 11, 2020 – The Federal Reserve released pricing (see schedule below) for its Municipal Liquidity Facility (MLF) program today….

Ahead of NYC’s First Post-COVID19 Bond Sale, Fitch and S&P Affirmed TFA (Personal Income Tax and Sales Tax Credit) at “AAA”, With Stable Outlook

May 9, 2020 – Ahead of a $726 million tax-exempt and taxable subordinate-lien bond sale next week, rating agencies affirmed…

One Year After California Quietly “Un-Banned” Wells Fargo From Muni Underwriting, The Bank Is Under Federal Investigation Again. Charges of Racism Taint Wall Street’s (Once) Favourite Bank.

May 7, 2020 – When making controversial decisions, politicians have learned that the best strategy is stealth. On April 3…

Eager to Avoid PPP Controversies, the Fed Is Requiring Municipal Borrowers To Certify Loss of Market Access

April 27, 2020 – After markets closed, the Federal Reserve announced an expansion of the Municipal Liquidity Facility (MLF). Specifically,…

BREAKING: Federal Reserve Municipal Liquidity Facility (MLF) “FAQ” May Be Published Today

April 24, 2020 – Based on BuyMuni’s broker-dealer sources, the Federal Reserve is believed to be publishing its Frequently Asked…

How A Morgan Stanley Report Might Stymie Future Stimulus Bills To Assist U.S. Corporations

April 21, 2020 – A report by Morgan Stanley is being scrutinized by market participants and political staffers for concluding…

Fed’s Muni Liquidity Facility May Have Few Takers. “Badly Designed”, Says a Bulge Bracket Public Finance MD.

A portion of the article below was previously published on April 14, 2020. April 17, 2020 – The investor community…

Opinion: Buyer of One – Why The Federal Reserve’s Municipal Liquidity Facility Will Worsen Muniland’s Long-Term Outlook.

April 14, 2020 – The Federal Reserve brought their “bazooka” into #Muniland last week, promising (guidelines are pending) to purchase…

Fitch Revised New York State “Outlook” to “Negative”. Says State May Need To Tap $10B Short-Term Liquidity.

April 11, 2020 – Fitch Ratings revised its outlook on New York State from “Stable” to “Negative” on Friday. This…

Bank of America Revised U.S. GDP Forecast. Expects 10.4% Cumulative GDP Decline in 2020 – Deepest Recession on Record.

April 2, 2020 – Bank of America’s U.S. Economics Team revised their economic forecast this morning, and now thinks the…

Opinion: How The 30-Year Level Debt Structure Is Killing Muni Innovation

April 1, 2020 – When I joined a bulge-bracket Public Finance shop in the 90s, my mentor touted the superior…

Breaking: Moody’s Revised New York State Outlook to “Negative”

April 1, 2020 – In a move not unexpected to municipal market participants, Moody’s revised its outlook for New York…

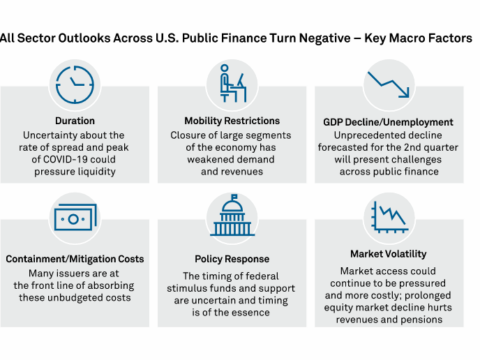

Breaking: S&P Downgraded All U.S. Public Finance Sectors to “Negative” Outlook

April 1, 2020 – No, it’s not an April Fool’s joke! In what is believed to be an unprecedented rating…

New York Poised To Ban Cigarette Sales; Tobacco Bonds In Jeopardy

March 28, 2020 – Based on two separate articles published today and on March 27, the Buffalo Chronicle reported that…

Opinion: How #Coronavirus Could Decimate Muni Credit

February 28, 2020 – Two weeks ago, when BuyMuni highlighted institutional investor concerns about the coronavirus outbreak, the stock market…

Citi To Investors: Stay The Course and Remain Invested

February 26, 2020 – One of the most controversial interest rate calls in #Muniland was made late last year by…

As Fear Grips Investors, Muni Players Ponder: Do Dark Clouds Lie Ahead?

February 24, 2020 – The Dow Jones Industrial Average lost 3.56%, or 1,031 points on Monday, while the S&P 500 and Nasdaq fell 3.35% and 3.71%,…

S&P Downgrades U.S. Ports

February 20, 2020 – In a report issued on February 19, S&P Global Ratings downgraded its U.S. ports outlook from…

Moody’s: Coronavirus Clouds Global Growth Outlook. Conditions Could Worsen If Virus Not Contained in Q1.

February 18, 2020 – In a report issued this week, Moody’s Investor Service opined that the coronavirus outbreak is likely…

PIMCO: Munis Outperformed in January Even As Secondary Activity Was Muted

February 13, 2020 – In its monthly municipal market review published today, PIMCO noted the Bloomberg Barclays Municipal Bond Index…

Despite Coronavirus Concerns, Morgan Stanley Is Bullish On Airport Credit

February 12, 2020 – Despite market fears that the current #coronavirus crisis might precipitate a global slowdown, Morgan Stanley issued…

NYC Tax Commission Shined Light On Glaring Inequities in Property Tax System

January 31, 2020 – The New York City Advisory Commission on Property Tax Reform (“Tax Commission”) issued a landmark report…

Moody’s: SCOTUS Refusal to Review Puerto Rico HTA Decision is Credit Negative For Utilities and Special Revenue Bonds

January 22, 2020 – In a report released today, Moody’s summarized the U.S. Supreme Court’s (“SCOTUS”) decision not to review…

Morgan Stanley: Weaker Returns Likely For Municipal Bonds.

January 21, 2020 – In a research report issued today, Morgan Stanley opined that rich valuations for municipal bonds are…

Citi: Muni Fund Flows and Issuance Exhibit Strong Start In the First Full Week of 2020

January 14, 2020 – Municipal bond funds reported inflows of $2.9 billion for the week ending January 8, according to…

Tax Flight Is Real: TX and FL Gain. NY, CA and NJ Lost Residents.

January 6, 2020 – In a report authored by Bank of America Securities analyst Ian Rogow, 2017-2018 migration data issued…

Bank of America Muni Recap for 2019: It Was A Rather Great Year

January 3, 2020 – In a report issued this morning by BofA Securities (“BAS”), analysts Yingchen Li and Ian Rogow…

BofA Tops NY League Table. Wells Fargo Shut Out – Head of Public Finance Seconded To Bill Daley’s Government Affairs “A-Team”

December 23, 2019 – Based on Thomson Reuters data released this morning, BofA Securities retained its traditional lead atop the…

Citi Forecasts 1% 10Y MMD. Buyers’ Regret For Issuers Biting Taxable Refunding Apple?

December 17, 2019 – After many years of analysts forecasting higher interest rates, Wall Street firms are taking a contrarian…

Opinion: Only $550/Month Property Taxes, If You Can Afford Paying $59 Million For This Hudson Yards Penthouse

Hudson Yards is an undeniable success. The Vessel – Thomas Heatherwick’s public installation – is a masterpiece that draws thousands…

Regulator Rebukes Wells Fargo (Again!). Bank Fired and Blacklisted Thousands of Low-Level Employees

December 4, 2019 – In an exclusive, the Wall Street Journal reported that the Office of the Comptroller of the…

Muni Bankers Should Savor Their 2019 Bonus. Lean Years Lie Ahead.

November 26, 2019 – About this time every year, Wall Street bankers begin the process of performance evaluation and bonus…

Opinion: Why A Rainy Day Fund Is A Terrible Idea for New York City

Time and again, American voters forgive politicians with bad ideas – so long as they possess slick delivery. Often, voters…

BuyMuni’s Ten Observations on New York City’s Comprehensive Annual Financial Report 2019

October 31, 2019 – New York City’s financials are a window into local government finances and the health of the…

GS/MS: Yesterday’s Fed Cut May Be Final Cut For A While

October 31, 2019 – Two major dealers – Goldman Sachs and Morgan Stanley – issued reports concluding yesterday’s FOMC 25bp…

Morgan Stanley: Many Brexit Scenarios, But “No-Deal” Now Increasingly Remote

October 29, 2019 – In a report issued today, Morgan Stanley noted that the United Kingdom’s Conservative Party leads the…

Mercer Family-Backed Conservative Group Accuses Municipal Bond Issuers Of Being Hypocrites on Climate Change

October 28, 2019 – In a Wall Street Journal opinion piece published yesterday, Peter Schweizer – President of a conservative…

S&P Cuts Tobacco Bond Ratings

October 25, 2019 – S&P Global Ratings downgraded 67 tobacco bond CUSIPs yesterday, citing weak cigarette sales and declining credit…

NYC Cash Balance Declined 25% in FY19; Lowest Year End Cash Balance Since 2013

September 9, 2019 – In its Quarterly Cash Report issue today, NYC Comptroller Scott Stringer’s Office reported that the City’s…

Should Issuers Execute Taxable Advance Refundings?

September 6, 2019 – With 10 and 30 year Treasuries hovering near historic lows, at 1.54% and 2.02% respectively, public…

BlackRock Reduced Long-Dated Bond Holdings in $11B Muni Fund

August 29, 2019 – BuyMuni’s analysis of BlackRock’s Strategic Municipal Opportunities Fund (“SMO Fund”) investor materials revealed tactical shifts within…

PIMCO: Recession Not Imminent, But Cautious In Outlook

August 28, 2019 – In a report issued this week, PIMCO’s Dan Ivascyn and Esteban Burbano discussed the current U.S….

Goldman: U.S. Housing To Improve Despite Headwinds

August 26, 2019 – In a research note issued yesterday, Goldman Sachs analysts concluded that U.S. housing is likely to…

Nuveen: Treasury Yields Mixed Due To Global Trade and the Fed

Highlights from Nuveen’s weekly 2019 Aug 26 fixed income commentary: Municipals were unchanged even as long duration-Treasuries improved (lower yield)…

Fitch: Most States Experiencing Revenue Growth But FY2020 Outlook Remains Cautious

In a report issued on August 1, 2019, Fitch Ratings (“Fitch”) analysts opined that most U.S. states are experiencing solid…

[Forbes] Municipal Bonds: A Positive Impact In Addressing Homelessness [Sponsored]

This is the fifth article in a series highlighting the most important aspect of municipal bonds: how the projects bonds…

How Low Interest Rates Could Wreck State/Local Budgets and Hurt Credit Quality

The past week was a bumper week in munis, with nearly $14 billion in new issuance. It was also one…

[Opinion] Moody’s Thinks Taxing the Rich Will Save New York’s MTA. There Is One Crack To This Argument.

August 8, 2019 – In a report issued today, Moody’s Investor Service laid out an argument in favor of New…

States Saddled with Retiree Healthcare Liabilities Would Benefit from Medicare-for-All. Correction: Their Bondholders Will.

If polls are to be believed, a majority of Americans are ready to remove President Trump in 2020, electing what…

[Op-Ed] Something Fishy Is Brewing in Illinois. Smells Like Bacalao.

This is not an op-ed about the state of Illinois’ credit. As a progressive, I am holding out for the…

Fed Chair Powell: Wells Fargo Governance Still Unsatisfactory. Banned From Underwriting NYC Bonds.

July 31, 2019 – Two words – “mid-cycle adjustment” – from the Federal Reserve rocked markets on Wednesday. But at…

[Forbes] Municipal Bonds: A Holistic View Of A Community’s Environment And Sustainability [Sponsored]

This is the fourth article in a series highlighting the most important aspect of municipal bonds: how the projects bonds…

El-Erian: U.S. Federal Reserve Should Not Deliver a Big Rate Cut

July 19, 2019 – In an Op-Ed posted on Bloomberg today, former CEO of PIMCO Mohamed El-Erian expressed concerns on…

Citigroup: 76% of Municipal Market “Screens Well” for ESG Investors

July 26, 2019 – In a report issued this week, Citigroup analysts said about $2.9 trillion of currently outstanding municipal…

[Op-Ed] The Growing “Optimism Divide” Between the North East and the South

[Opinion] July 24, 2019 – Sitting through the issuer presentations at the J.P. Morgan Transportation and Utility Conference in New…

How Governor Cuomo’s Free College Tuition Program Is Destroying New York’s Private Colleges

July 22, 2019 – Bloomberg’s Amanda Albright reported how New York’s free college tuition plan “tore a hole in the…

[Op-Ed] New York Should Stop Awarding Bond Underwriting Business to Goldman and Wells Fargo

New York considers herself an enlightened state. From educational equity to gay marriage; NYC ID to tenant protection, both State…

[Op-Ed] Can Lloyd Blankfein Become New York City’s 110th Mayor?

July 15, 2019 – At a Hamptons party this weekend, yours truly stumbled on a particularly raucous conversation on the…

Landmark “Janus” Ruling Hasn’t Erode Union Power, Yet.

July 12, 2019 – Despite the landmark Supreme Court Janus ruling that non-union governmental workers may not be required to…

Moody’s Is Skeptical About Economic Development Programs – “Hurt Government Credit Quality”

July 10, 2019 – In a report issued today, Moody’s Investor Service expressed concerns on economic development and/or job incentive…

Why The Best Performing Funds May Not Be Distributed Through Your Brokerage House

July 9, 2019 – In a recent report, Barron’s highlighted the “pay-to-play” arrangement involving large brokerage houses like Morgan Stanley,…

[Moody’s] Citizenship Question on Census 2020 Could Still Materialize, Impacting Medicaid Reimbursements

June 27, 2019 – Moody’s Investor Service said today that the Supreme Court’s June 27 decision did not fully rule…

Citi Analysts: Questionable Attempt to Question the Legality of Illinois GO Debt

July 2, 2019 – In a “flash” note issued late Monday, Citi’s municipal analysts Vikram Rai and Jack Muller cast…

Nuveen: Expect A Tougher Climb

June 24, 2019 – Nuveen has issued its 2019 Midyear Update covering several asset classes including equities, taxable fixed income,…

Bank of America Data Shows Increasing Dominance of SMAs

July 1, 2019 – In a report issued on June 28, 2019, Bank of America Merrill Lynch (“BAML”) said, based…

[Opinion] The Art of Self-Gifting: Stanford’s $4.7 Billion “Package” For Local Housing and Schools

June 24, 2019 – Stanford University, whose $20+ billion endowment ranks as one of the largest in the nation –…

[Opinion] Should Issuers Refund Build America Bonds (BABs)?

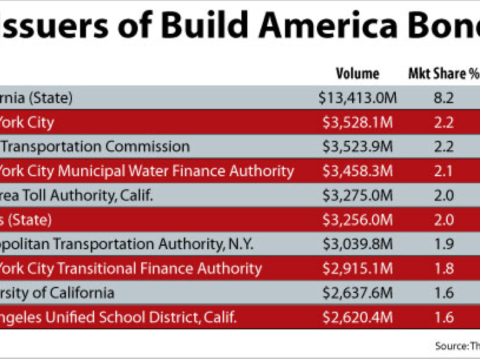

Build America Bonds are the gift that keeps on giving. The U.S. Treasury Department estimated in 2011 that state and…