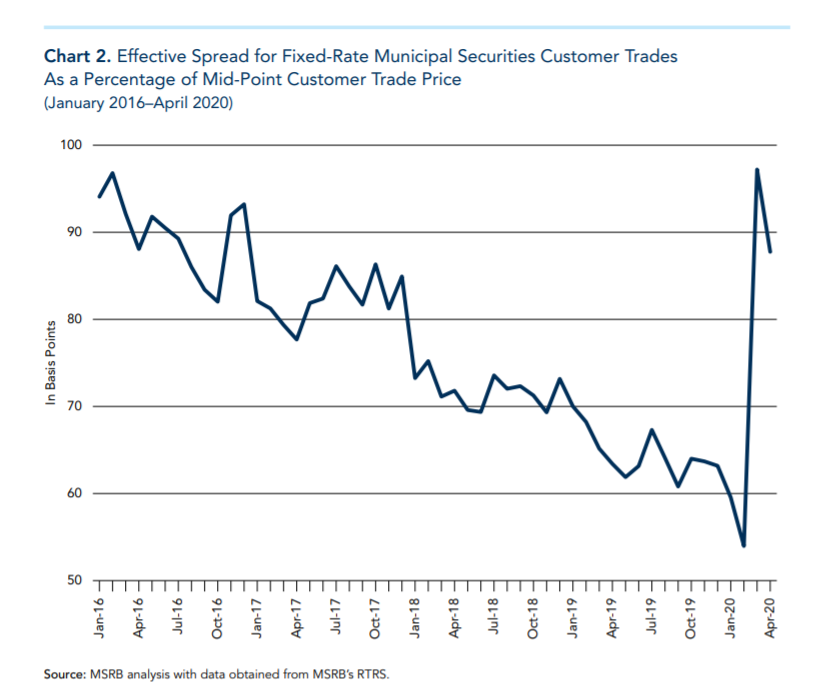

May 28, 2020 – Based on a recent report issued by the Municipal Securities Rulemaking Board (MSRB), the average effective spread for municipal securities rose from 55 basis points in February 2020 to 97 basis points in March 2020. During the nadir of the recent crisis, effective spreads widened to as much as 165 basis points.

Unlike equities, most fixed income securities including municipal bonds are traded on an over-the-counter basis. But while bonds for large corporate issuers like Boeing, IBM and Apple can trade at bid-ask or effective spreads as little as 15-20 basis points (depending on maturity), municipal bond trading spreads have been notoriously high.

MRSB had estimated effective spreads to be in the 95 basis point region in early 2016. As pricing transparency has increased in recent years (thanks to MSRB efforts and a growing use of technology to match trades), effective spreads declined to new lows in 2020, only to have four years of progress unraveled in the span of two weeks between late March and early April as a result of COVID-19 market dislocations

The MSRB, unsurprisingly, found that trade sizes mattered. Trades with par values of $10,000 or less “suffered” effective spreads as much as 70 basis points wider than $1+ million value trades. But even for high-value trades, COVID-19 dislocations caused a material bump in costs or approximately 50% of Feb 2020 spreads in basis points.

Contact Jumanne Johnson at JJohnson@buymuni.com.