Category: New Issue

NYC Prices $1.4B GO Transaction. First Post-COVID Sale Locks In $240 Million In Savings.

Karen Bigelow August 27, 2020

August 27, 2020 – New York City priced its first General Obligation transaction since the onset of COVID-19. Based on…

New York City’s TFA Refinances Debt, Locks In Over $370 Million of Debt Service Savings

Jumanne Johnson August 20, 2020

August 20, 2020 – In a press release released by the Mayor’s Office of Management and Budget, Comptroller Scott Stringer…

NYC’s Personal Income Tax-Backed Bonds Receive Warm Investor Reception; Oversubscribed by 11x

Jumanne Johnson May 13, 2020

May 13, 2020 – New York City’s premier credit – the AAA-rated Transitional Finance Authority (TFA) – received a warm…

Ahead of NYC’s First Post-COVID19 Bond Sale, Fitch and S&P Affirmed TFA (Personal Income Tax and Sales Tax Credit) at “AAA”, With Stable Outlook

Karen Bigelow May 9, 2020

May 9, 2020 – Ahead of a $726 million tax-exempt and taxable subordinate-lien bond sale next week, rating agencies affirmed…

Citi: Muni Fund Flows and Issuance Exhibit Strong Start In the First Full Week of 2020

Jumanne Johnson January 14, 2020

January 14, 2020 – Municipal bond funds reported inflows of $2.9 billion for the week ending January 8, according to…

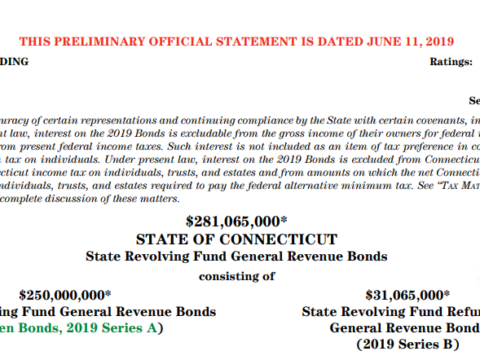

[NEW ISSUE] State of Connecticut – State Revolving Fund General Revenue Bonds

BuyMuni New Issues June 12, 2019

The State of Connecticut is selling tax-exempt State Revolving Fund (“SRF”) General Revenue Bonds on Thursday, June 20th, 2019. A…