Category: Rating Agencies

Puerto Rico Statehood Is Credit Positive Due To Medicaid, But Commonwealth May Lose Triple Tax Exemption

November 5, 2020 – Puerto Rico voters appear to have voted in favor of statehood by a 52-48% margin (votes…

S&P: Prolonged Revenue Weakness Could Pressure Convention Center Credit Ratings

July 27, 2020 – As reopenings in California and Sun Belt states are halted, S&P Global Ratings said today it…

Ahead of NYC’s First Post-COVID19 Bond Sale, Fitch and S&P Affirmed TFA (Personal Income Tax and Sales Tax Credit) at “AAA”, With Stable Outlook

May 9, 2020 – Ahead of a $726 million tax-exempt and taxable subordinate-lien bond sale next week, rating agencies affirmed…

Breaking: Moody’s Revised New York State Outlook to “Negative”

April 1, 2020 – In a move not unexpected to municipal market participants, Moody’s revised its outlook for New York…

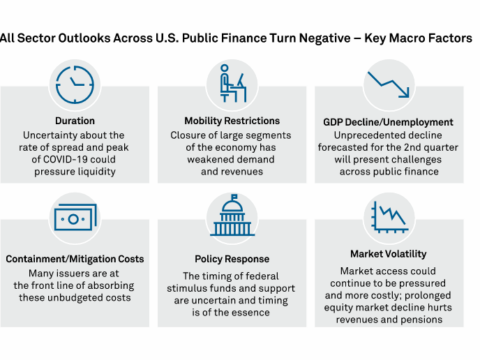

Breaking: S&P Downgraded All U.S. Public Finance Sectors to “Negative” Outlook

April 1, 2020 – No, it’s not an April Fool’s joke! In what is believed to be an unprecedented rating…

Moody’s: SCOTUS Refusal to Review Puerto Rico HTA Decision is Credit Negative For Utilities and Special Revenue Bonds

January 22, 2020 – In a report released today, Moody’s summarized the U.S. Supreme Court’s (“SCOTUS”) decision not to review…

S&P Cuts Tobacco Bond Ratings

October 25, 2019 – S&P Global Ratings downgraded 67 tobacco bond CUSIPs yesterday, citing weak cigarette sales and declining credit…

Fitch: Most States Experiencing Revenue Growth But FY2020 Outlook Remains Cautious

In a report issued on August 1, 2019, Fitch Ratings (“Fitch”) analysts opined that most U.S. states are experiencing solid…

Moody’s Is Skeptical About Economic Development Programs – “Hurt Government Credit Quality”

July 10, 2019 – In a report issued today, Moody’s Investor Service expressed concerns on economic development and/or job incentive…

[Moody’s] Citizenship Question on Census 2020 Could Still Materialize, Impacting Medicaid Reimbursements

June 27, 2019 – Moody’s Investor Service said today that the Supreme Court’s June 27 decision did not fully rule…