Build America Bonds are the gift that keeps on giving. The U.S. Treasury Department estimated in 2011 that state and municipalities saved upwards of $20 billion in borrowing costs, even after taking into account higher issuance cost incurred in the corporate investment grade market.

The true benefit to issuers was much higher, as tax-exempt supply was constrained in 2009-2010 as a result of BAB issuance. Double dipping proved so attractive to reducing debt service budgets that even skeptical public finance officers started to issue BABs.

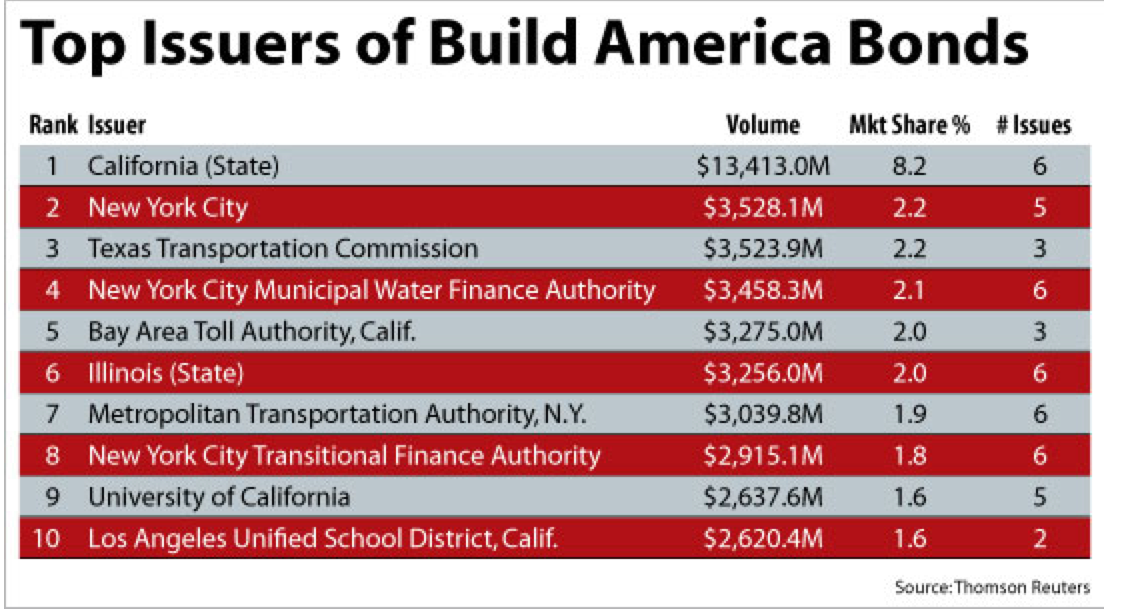

Fast forward to 2019, and an estimated 25-30% of BABs issued in 2009 and 2010 (the program subset at the end of 2010) are now callable, either on a current basis or an advance basis. For large issuers like California and New York City, the option to advance refund BABs with tax-exempt debt is an unexpected boon, as the Tax Cut and Jobs Act (TCJA) curtailed issuers’ ability to advance-refund bonds with tax-exempt debt.

Additionally, sequestration actions have reduced Federal interest subsidy by 7-9% annually, which reduced the effective interest subsidy to 32% from the promised 35%. Many BABs were issued in the 25-30-year range, and those bonds now have an effective maturity of 15-20 years, further increasing the option value associated with refunding the bonds.

So if you are a municipal debt manager who has issued BABs with optional redemption provisions (typically a 10-year par call), it should be a slam dunk to refund these bonds, yes?

In most cases, but there are a few caveats.

Credit Spreads. While credit quality and ratings for many issuers have improved meaningfully since 2009 (arguably the heart of the financial crisis), there remain a minority of issuers that have experienced fiscal stress and deteriorating credit quality. Refinancing BABs, while a good proposal on paper, may not be an option.

Market Saturation Concerns. For the largest issuers in the market, refunding BABs would entail a net supply of tax-exempt paper, while eliminating an investor base (life insurers, foreign companies and wealth funds) that is unlikely to reinvest in tax-exempt bonds. Thankfully, the municipal market remains strong and is probably capable of absorbing $20-30 billion supply of refinanced BABs (into tax-exempt bonds). For the Californias, New Yorks and MTAs of the world – saturation is always a concern hence BAB refinancings should be carefully weighed against issuance programs for the intermediate term (1-3 years).

Take Savings Now or Wait? Like any refunding, issuers need to make an interest rate call on whether to redeem BABs with call dates that are 6-18 months away now or wait until bonds become currently callable. Here, the decision seems to lean towards taking money off the table now – despite some market trepidation this week, municipal yields remain close to recent lows. Municipal bond funds are flushed with cash, and some are setting aside concentration concerns on large credits because there just isn’t enough supply to go around. Short-term Treasuries at 2% provide a boost to refunding savings – not to be taken for granted given many economists’ forecast for rate cuts.

Investment bankers and institutional investors are eyeing BAB refundings like children admiring candy. 2019 supply has been muted, underwriting fees have been depressed while municipal returns scant.

In the absent of fresh hits on the radio, an old remake will do.

*****

Contact Andy Gem at andygem@buymuni.com