July 20, 2020 – Morgan Stanley waded into the Congressional prediction sweepstakes today, predicting that Congress will extend up to $600 billion in federal aid to states, local governments and hospitals; as well as authorize advance refundings.

Under the enacted Tax Cuts and Jobs Act of 2017, issuers were barred from issuing new tax-exempt bonds to refinance bonds with call dates beyond 90 days. The reinstatement of advance refundings is expected to cost the Federal government $14 billion in lost revenues.

If the “Base Case” prediction ($364 – 614 billion in value) comes to pass, Morgan believes the market will be on track for “moderate outperformance”.

Under a “Bull Case” scenario ($630 in value), additional aid could be fothcoming for higher education and transit authorities, which combined with stimulus checks for consumers, could herald a “V-shaped” economic recovery, further improving municipal credit.

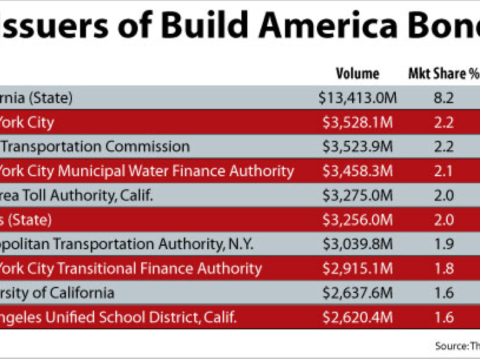

Morgan Stanley said two provisions heavily sought after by Congressional Democratic caucus – the reinstatement of Build America Bonds and the removal of the State and Local Tax (SALT) cap – do not have bipartisan support and are unlikely to pass.

Note, the stimulus described above relates to provisions directly impacting municipals. There is considerable bipartisan support to assist Americans impacted by COVID-19 through either direct stimulus payments and renewing enhanced federal unemployment assistance, albeit at a rate lower than the current $600/week benefit.

Experts say the $600/week benefit represents a higher monetary sum than actual wages earned for 70% of unemployment benefit recipients, potentially impeding economic recovery by disincentivising workers to return to work.

News reports indicate President Trump is heavily promoting a payroll tax cut, although Congressional support for the proposal has been tepid.

While issuers may welcome a return of advance refundings, two portfolio managers BuyMuni spoke to indicated a sudden, large influx of new tax-exempt paper (even if it’s for refunding purposes) may result in higher spreads for the remainer of 2020. While over the long-term, munis remain an asset class with attractive risk-return profile, higher interest rates will be unwelcomed at a time where states and local governments are suffering budget stress.

Contact Kyle Skinner at KSkinner@buymuni.com.