January 31, 2020 – The New York City Advisory Commission on Property Tax Reform (“Tax Commission”) issued a landmark report today highlighting the the inequities in the largest city in the United States.

Established by Mayor Bill deBlasio and City Council Speaker Corey Johnson in 2018, the Tax Commission was charged with making recommendations for the city’s archaic and confusing property tax system, while ensuring there there is no reduction in revenues to the city.

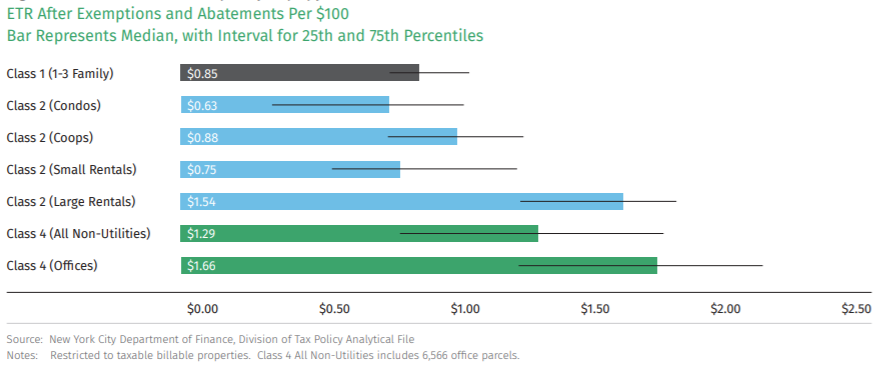

The City uses different methodologies to levy property taxes on four distinct categories of property. Class 1 consists of smaller homes (1-3 families) and are dominated by Brooklyn brownstones and homes in Queens, Bronx and Staten Island. Class 2 comprises mostly of condos, coops and rental buildings, while Class 4 comprises of commercial buildings. A very small category – Class 3 – comprises utility assets.

Based on the Tax Commission’s analysis of City Department of Finance data, single family homes and a small number of preferential condos (with tax abatements) pay relatively lower taxes than co-ops and much lower taxes than large rental buildings (see chart below). Some activists claim that this system is extremely inequitable as wealthy Manhattan single family homes and Brooklyn brownstone owners pay a pittance off property tax (as a % of their home values) relative to the implicit tax paid by renters.

The Tax Commission has made ten initial recommendations. Their proposals will need to be approved by City Council and the State legislature before taking effect.

Among the proposals include:

- Assessing every property in the residential class at “full market value” based on a sales-based methodology. This would eliminate the current “tax buffer” enjoyed by properties that have experienced very large price increases over the city’s property tax boom but are assessed at very low levels due to rules limiting the maximum annual increase in assessed values. Properties that are likely to experience increase in taxes include single family homes in Manhattan and Brooklyn, and Manhattan co-ops. Properties in Staten Island where market values are lower will likely see their taxes reduced or grow more slowly.

- Creating a tax subsidy for low income home owners so such home owners will receive some form of a rebate to alleviate the impact of potentially higher taxes

The Tax Commission consists of twelve individuals including ex-officio members from City agencies. The Chairman is Marc V. Shaw, a former Senior Vice Chancellor for Budget, Fniance and Financial Policy at CUNY and a former senior advisor to the MTA.

Contact Andy Gem at AGem@buymuni.com,