February 26, 2020 – One of the most controversial interest rate calls in #Muniland was made late last year by the Citi Municipal Research team. The call was for 10-year AAA munis to hit 1%.

That call crystallized yesterday, as extreme volatility forced investors into Treasuries and low-risk fixed income assets. 10-year MMD ended the day at 0.98%.

According to CNBC, municipal yields are now at 40-year lows. Municipal bond funds have reported 60 weeks of consecutive positive fund flows, another record. High tax state funds including California and New York continue to gain assets even as the Tax Cuts and Jobs Act negatively impacted local property prices and disposal income.

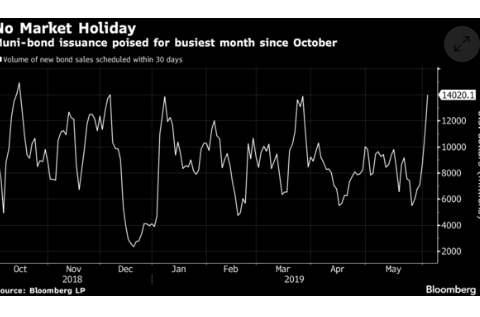

Heading into March, market participants may be tempted to de-risk from munis. March is also thought of as a technically more challenging month as redemption activity is historically lower.

The Citi team recommended caution, saying:

We cannot say for sure if we will truly see better entry points over the next month, though we should some relief from the recent richness. Essentially, we do not have any new advice to offer our tax-exempt investor clients except that it is crucial to remain invested and not step-off to the sidelines, as we do not have conviction that the tax-exempt market will cheapen any time soon.

Contact Kyle Skinner at KSkinner@buymuni.com.