June 24, 2019 – Nuveen has issued its 2019 Midyear Update covering several asset classes including equities, taxable fixed income, municipals, real assets, real estate and responsible investing.

Jose Minaya, President and CIO, said:

We think the second half of the year will be tougher than the first. At the start of the year, we pointed to a trade war escalation as the downside scenario. And now we need to acknowledge that this has come to pass. In addition, we’re focusing on the possibility of a weaker economic environment over the coming months. And we don’t think we have seen the end of downside corporate earnings revisions.

Brian Nick, Chief Investment Strategist, said:

Global consumers remain an important bright spot. Unemployment rates in most major economies are still quite low, and real wage growth has accelerated thanks to the lower supply of available workers and decreasing rates of inflation. In the U.S., both major monthly surveys of consumer confidence show continued optimism about the individual and collective economic outlooks

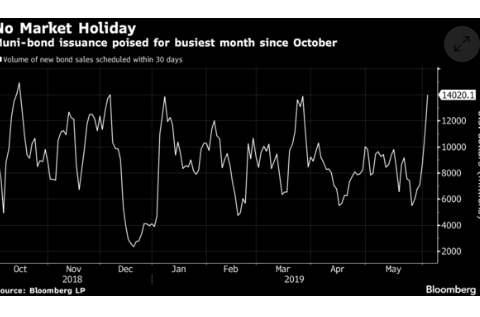

John Miller, Co-Head of Fixed Income and Head of Municipals, said:

The municipal market has shown solid performance so far in 2019, and we expect that trend to continue… Defaults remain low while credit upgrades are consistently exceeding downgrades, with numerous upside surprises to state-level revenue collections versus budget in the first quarter of 2019, including California, New York, Connecticut and Illinois.

So what could go wrong? The biggest risks we see for municipals are the possibility of a more hawkish stance from the Fed and/or a rise in inflation. Either or both of these scenarios could cause municipal bonds to falter.

To obtain a copy of the full report, visit www.Nuveen.com or contact Nuveen at 1 (800) 752-8700 (phone line for advisors) or 1 (800) 257-8787 (phone line for investors).

Contact Jumanne Johnson at JJ@BuyMuni.com.

To sponsor content at BuyMuni.com, contact MattBrown@BuyMuni.com.