August 29, 2019 – BuyMuni’s analysis of BlackRock’s Strategic Municipal Opportunities Fund (“SMO Fund”) investor materials revealed tactical shifts within the municipal portfolio that may have weakened market demand for long dated municipal bonds in July and early August.

In the fund’s Monthly Commentary material, Head of BlackRock’s Municipal Bond Group, Peter Hayes, wrote:

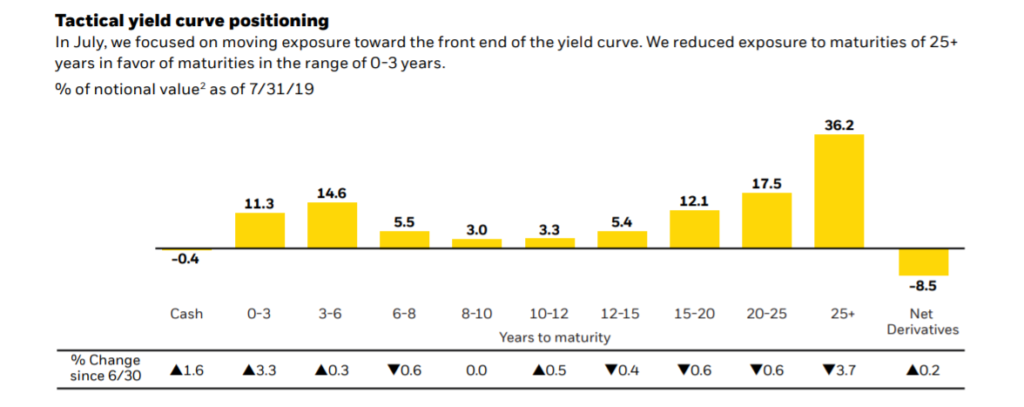

In July, we moved from a shorter to a more neutral duration stance after interest rates moved higher. We tactically used hedges to adjust overall duration and capitalize on interest rate volatility. We maintain a barbell yield curve strategy with concentrated exposures in maturities of 0-6 and 20+ years. The fund’s overweight in 20+ years contributed to performance in July, while an underweight in the range of 10-15 years detracted. We recently reduced exposure to terms of 25+ in favor of 0-3 years given the low levels of interest rates and historically rich valuations of municipals versus Treasuries.

Based on the investor materials and a back-of-envelop calculation, the 5% reduction in July for municipal bonds maturing 15 years and out would have translated to $500 million of secondary supply from the SMO Fund alone, which may explain the volatility in the new issue market since July.

Going forward, while lower interest rates have historically resulted in increased supply, issuers are currently constrained by the inability to use new tax-exempt debt to “advance-refund” high coupon bonds for savings. Thus, Blackrock expects the municipal market to be well supported.

As for coverage sectors, Blackrock said that the fund increased exposure to utilities, housing and local tax-backed credits in July, while reducing state tax-backed exposure which “can be vulnerable to political risk stemming from state and local budget negotiations.”

The SMO Fund is Blackrock’s largest non-ETF fund, with over $11 billion in assets. The fund has been ranked a Top 15 fund (out of about 200 funds) by Morningstar over 3, 5 and 10 years. Over the past year, the fund has underperformed 3/4ths of peer funds. The benchmark index is the Morningstar Muni National Intermediate benchmark index.

Contact Kyle Skinner at KSkinner@buymuni.com.