July 1, 2019 – In a report issued on June 28, 2019, Bank of America Merrill Lynch (“BAML”) said, based on a review of internal bank data, tax-exempt bond holders’ utilization of Separately Managed Accounts (“SMAs”) is showing strong growth and increasingly dominant as an alternative to direct holdings of tax-exempt securities.

Notably, during the period of 2Q2017 through 3Q2018, direct holdings of tax-exempt bonds declined every quarter, while holdings through SMA structures grew in every quarter except for one (1Q2018).

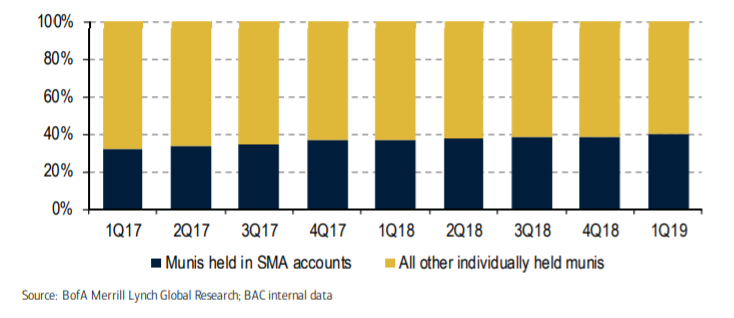

Between the two year period of 1Q2017 and 1Q2019, BAML estimated that SMA tax-exempt accounts grew by an average 2.2% quarter over quarter. As shown in the chart below, the share of SMAs within BAML individual tax-exempt holdings has grown from 33% to 40%.

Unsurprisingly, the bulk of SMA holdings are in the 3-10 year maturity range, which is the typical SMA offering that often caps mandates to maturities within 10 years. BAML noted that in recent quarters, holdings over 10 years have grown.

BuyMuni interviewed a few large brokerage teams in New York City, some of whom expressed concern that a continuing shift of municipal holdings into professionally-managed SMAs could negatively impact the broker-holder relationship and diminish advisors’ investment recommendations. There were also a few advisors who were sanguine about the development, noting that SMAs offered increased transparency compared to third party, and even internal, bond fund structures.

To obtain a copy of the report, contact your BAML sales representative or investment banker.

Contact Jim Doe at JimDoe@BuyMuni.com.