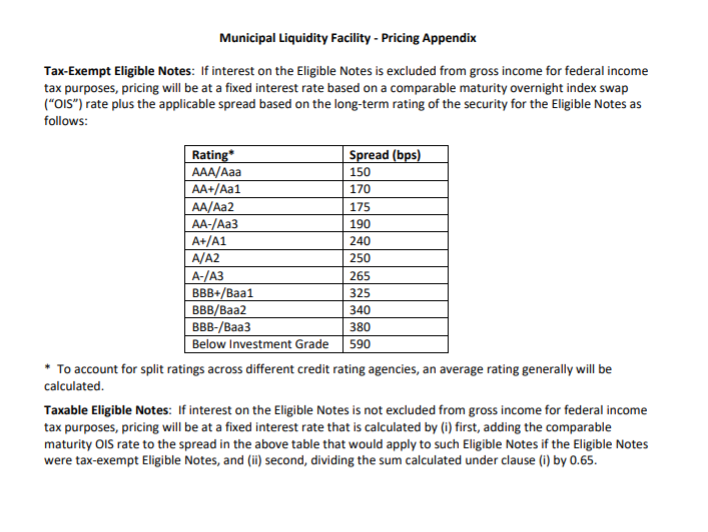

May 11, 2020 – The Federal Reserve released pricing (see schedule below) for its Municipal Liquidity Facility (MLF) program today.

Two bulge-bracket dealers BuyMuni spoke with were of the view that the credit spreads were “reasonable”.

“As the benchmark being used is Fed Funds rate not LIBOR or Treasuries, the credit spreads are the effective borrowing rate”, said a New York-based trader.

The MLF is expected to benefit a myriad of issuers from transit agencies (borrowing through state-level allocations) to states like Connecticut, Illinois, New Jersey and New York.

For New York State, the epicenter of COVID-19, the MLF program could be an attractive borrowing option. Recent legislative action has paved the way for “deficit borrowing” by the State.

Based on Federal Reserve eligibility requirements and at its current Aa1 rating, the State could borrow as much as $22 billion (which would require additional legislation as the amount approved was about half the total eligible amount) at an extremely attractive rate of 1.75%.

The industry benchmark rate – MMD – has ranged between 0.6 – 2.5% over the last two months, and New York municipal issues on the short end tend to price at a spread of 15-50 basis points.

“While the investor community has a very high regard for the Governor, there isn’t much of a chance of a $10B borrowing even at the short end without a hefty size concession of 80 – 150 basis points”, said a dealer of New York debt.

“The Federal Reserve is in competition with private buyers, and in this case, has provided a near-limitless put option” he said.

“Thankfully, they’ll eventually have to come back to the market and refinance the Fed paper”.

Contact Kyle Skinner at KSkinner@buymuni.com.