If polls are to be believed, a majority of Americans are ready to remove President Trump in 2020, electing what may potentially be a transformative Democratic President with a mandate to govern on a “progressive” agenda.

This writer is skeptical that Congress–regardless of party control–will have the appetite and political will to pass the sweeping changes that a President Bernie Sanders, Elizabeth Warren or Kamala Harris has promised voters. And no issue looms larger than healthcare, where three of the top four Democratic candidate has publicly stated that they are in favor of “Medicare-for-All” (M4A).

The contours of “Medicare-for-All” are vague, but most experts agree that under most of the proposals being bandied by Democratic candidates for President, M4A would entail some form of a takeover of the healthcare system by the federal government. Most healthcare providers will still remain private entities, but by assuming the rule of primary payor for services, the federal government will indeed call the shots.

The corollary, is the Feds will also have to foot the bill.

Yes there will be new taxes to be imposed on the ultra wealthy, possibly a wealth tax, although the more likely scenario is an across-the-board increase in taxes for both the middle-class and the wealthy. Those with high healthcare costs will benefit and rejoice. But more Americans, as the payor not the recipient of healthcare, will be very unhappy indeed and I wouldn’t want to be a Democrat running in a red or purple district in 2022.

The other group of beneficiaries–and this is not a potential development that has been properly flushed out by the media–are states and local governments. More specifically, bondholders of securities issued by states and local governments.

Pew Research estimates that U.S. states have incurred post-retirement healthcare liabilities of nearly $700 billion, based on 2016 data. Everything remaining constant, this liability will keep on increasing unless healthcare costs go down (not likely), investment returns perform superlatively (possible but not guaranteed) and state/local government employee rolls dramatically decrease (definitely not likely).

Based on 2016 financials, Pew estimates that less than 10% of post-retirement healthcare liabilities are funded, which is an astounding under-funding. In some states including New Jersey and New York, the unfunded post-retirement healthcare liabilities are almost as large as the debt of the states.

In it’s December 2018 report entitled, “State Retiree Health Care Liabilities: An Update,” Pew Research said:

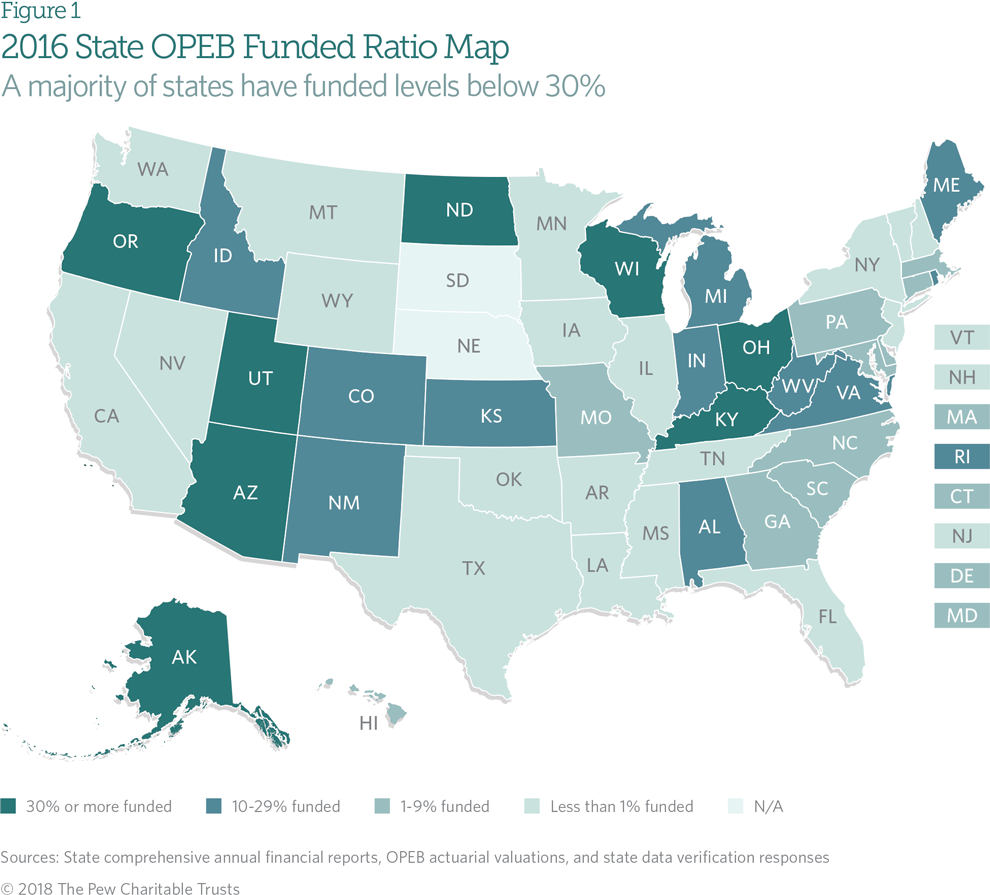

“Of the 48 states that reported OPEB liabilities in 2016, 19 have not put aside any funds to pay for promised benefits or their available funds are negligible; 10 have a funded ratio of less than 10 percent; 11 have a funded ratio of 10 to 29 percent; and only eight have a funded ratio of 30 percent or above. (See Figure 1.) Nebraska and South Dakota do not recognize OPEB in state financial reports. In contrast, every state pre-funds the pension benefits offered to public workers, with an average funded ratio of 66 percent.“

Less Protected Than Pensions, But Still Packs A Bite

While post-retirement health benefits are not as protected as public pensions, and there is some precedent where states and municipalities have reduced unfunded liabilities by restructuring health benefits for retirees, such restructuring is not popular and–not surprisingly–faces heavy resistance from unions and activists.

In fact, one Democratic Presidential candidate, Ohio congressman Tim Ryan, argued during the second debate hosted by CNN that unions were be hurt by Medicare-for-All because the unions have negotiated attractive healthcare benefits for workers and retirees.

Labor negotiations is, of course, one of the most arcane aspects of municipal government. Unions don’t like to highlight good deals they have negotiated for fear of public backlash. Many governmental officers “bury” their post-retirement healthcare acturial report in secluded parts of public websites and open data portals.

But make no mistake, the CFOs and Budget Directors of states and local governments are well aware that Medicare-for-All could serve as a miracle panacea that can make $700 billion of liabilities go away overnight.

Should historic M4A legislation pass, states will nominally benefit. Bond investors will rejoice, but they should spare a thought for their family and friends working in municipal government who will likely end up with inferior post-retirement healthcare benefits.

Contact Caren Moses at CMoses@BuyMuni.com.