January 6, 2020 – In a report authored by Bank of America Securities analyst Ian Rogow, 2017-2018 migration data issued by the IRS on December 31, 2019 provided further evidence of the phenomenon analysts termed “tax flight” – where residents moved from high-taxed states to lower-taxed states.

While tax flight theories are not new, market participants and credit analysts were particularly interested in the 2017-2018 data that came out, since this represented the first migration-related data point post Tax Cuts and jobs Act (TCJA).

TCJA restricted the state and local tax (SALT) deductions on individual tax returns to $10,000, effectively increasing the tax burden on high-taxed states like New York and California.

According to Rogow, IRS-compiled Adjusted Gross Income (AGI) metrics showed a net inflow of $31.7 billion AGI moved from high-taxed states to low-taxed states in 2018 vs under $20 billion in 2016.

Over a 12-year period between 2006 and 2018, over $200 billion of AGI have “relocated” from high-taxed states to low-taxed states, according to the IRS data.

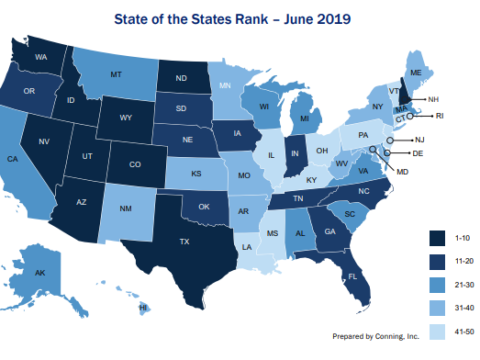

Rogow noted that the IRS data corroborated the 2019 domestic net migration data released by the U.S. Census Bureau:

“More Americans are choosing Texas and Florida – both states with no state income tax – as their primary destination. At the same time, New York, California and New Jersey – each high-tax states – are among those losing the most residents; in the aggregate, those three states

lost over 433,000 Americans to other states in 2019.”

Ultimately, out-migration from high-taxed states does not just drain state coffers of revenues, but also impact states’ congressional seats. According to analysis by Election Data Services, Texas and Florida are expected to increase their House seats by 3 and 2, respectively, by 2020. The majority of states in the North East (where Democrats dominate) will lose a seat.

Contact Caren Moses at CMoses@buymuni.com.