July 9, 2019 – In a recent report, Barron’s highlighted the “pay-to-play” arrangement involving large brokerage houses like Morgan Stanley, Fidelity and Bank of America Merrill Lynch.

Known as revenue-sharing arrangements, contracts between fund companies and brokerage houses are worth tens of billions of dollars of revenues and “infrastructure fees”, levied as a percentage of assets.

Fidelity and Charles Schwab reportedly charge 0.4 – 0.5% of assets for funds to be included in the firms’ no-transaction fee trading platform.

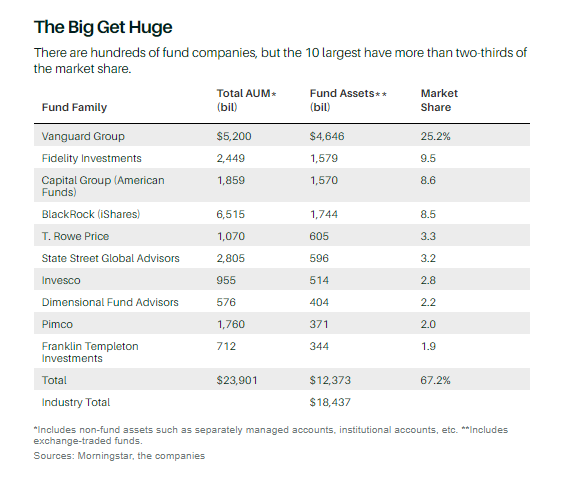

Based on the Barron’s report, Morgan Stanley listed in its disclosure 61 fund companies that contributed an aggregate amount of at least $15 million to Morgan Stanley in 2017, excluding revenues from other sources like data services, hosting and asset-based fees. The funds are household names – Legg Mason, Franklin Templeton, American Funds, PIMCO, Invesco and even the big kahuna of asset management – Blackrock.

Conspicuously absent is Vanguard, who to our knowledge, refuses to pay distribution fees to third party brokerage platforms.

As a result of the platform fees, legal/due diligence barriers and brokerage houses’ preference to work with larger funds, smaller funds which may perform well may be shut out from the large brokerages.

“Cracking the wirehouses has been a challenge from the beginning,” says Brian Yacktman, whose $257 million fund has beaten the S&P 500 and 97% of its peers over the past five years. The wirehouses want to see a very large asset base and they make it difficult for a fund like ours to get in.”

The purge of smaller or under-performing funds from large distribution platforms has accelerated in the past few years. Merrill Lynch removed half of its funds, taking the total down to 1,800. UBS similarly has trimmed hundreds of funds from its brokerage platform, down to just over 2,800 from 3,580 a year ago.

Greg Trinks, Head of U.S. Funds at UBS, said: “Small funds can make the cut if they meet due-diligence criteria but in general, it’s more difficult to get onto the shelves at UBS and our competitors.”

Representatives from Morgan Stanley, Fidelity and UBS declined to speak with BuyMuni when contacted about this article.

Contact Jenny Lee at JLee@BuyMuni.com.