[WSJ] A 10-Year Treasury Yield Below 2% Is Something Almost Nobody Saw Coming

June 20, 2019 – The Wall Street Journal reported today that investors and other experts in the financial industry were…

[WSJ] Connecticut’s Blue Politicians Spill an Ocean of Red Ink

The Wall Street Journal reported on June 14, 2019 that Connecticut’s biennial budget soon to be signed by new Democratic…

[BAML] Munis Now Cheap to Treasuries. “The Longer the Better”.

In their June 14, 2019 Municipal Weekly report, BAML’s Municipal Research team led by Phillip Fisher offered the following takeaways:…

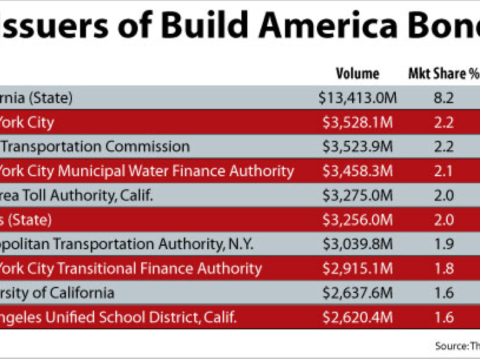

[Opinion] Should Issuers Refund Build America Bonds (BABs)?

Build America Bonds are the gift that keeps on giving. The U.S. Treasury Department estimated in 2011 that state and…

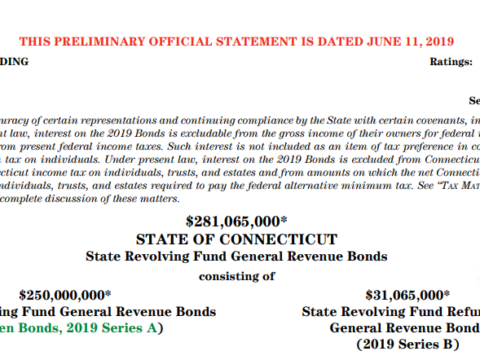

[NEW ISSUE] State of Connecticut – State Revolving Fund General Revenue Bonds

The State of Connecticut is selling tax-exempt State Revolving Fund (“SRF”) General Revenue Bonds on Thursday, June 20th, 2019. A…

[BondBuyer] Cook County Mulls Securitization as Revenue Bonds Face Pressure

The Bond Buyer reported on June 10, 2019 that Cook County, Illinois is considering a securitization structure to lower borrowing…

Just How Much Of A Rainy Day Reserve Does NYC Need?

According to the Citizen’s Budget Commission (CBC) – a nonpartisan think-thank – a whopping 17% of tax revenues, which would…

[Events] 6/27 Kroll Breakfast Briefing: Has Special Revenue Bond Protection Been Turned On Its Head?

Kroll Bond Rating Agency is hosting a discussion on special revenues and the U.S. Court of Appeals for First Circuit’s…

[Moody’s] Bank Credit and Liquidity Support Flat As Issuer Variable-Rate Issuance Wanes

Moody’s Investors Service said today $7.5 billion of bank facilities (Letters of Credit, LOCs and standby liquidity) were underwritten or…

[BRECKINRIDGE] Why Muni Investors Should Care About Cybersecurity

In a May 28 note to investors, Breckinridge’s Alriona Costigan and Jesse Starks noted the disproportionate risk of cyber security…