[CITI] Municipal Market Shrank $2.1 Billion in Q1

Citigroup’s Municipal Markets Research issued a report this morning indicating the municipal bonds market shrank by approximately $2.1 billion in…

[IFR Markets] Could Trump Be Setting A Trap?

On Thursday, IFR Markets’ Duncan Balsbaugh hypothesized that President Donald Trump could be setting a trap for the Federal Reserve,…

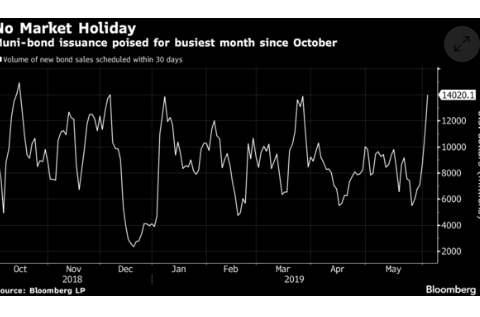

[Bloomberg] Muni Market’s $14 Billion Calendar Hints at Year’s Busiest Month

Bloomberg reported that state and local governments are scheduled to issue $14 billion in municipal bonds over the next 30…

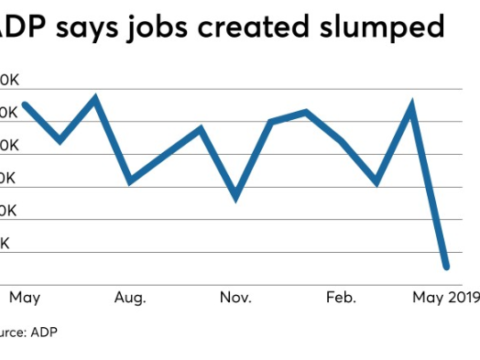

[BondBuyer] ADP Report Fuels Rate Cut Clamor

The BondBuyer reported yesterday that a disappointing read from the ADP employment report overshadowed a positive read on the service…

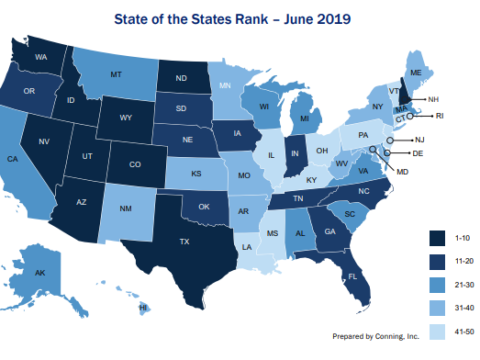

[OP-ED] What The Conning Report Should Really Be Saying: Decades Of Hispanic Migration Have Boosted Credit Quality

Conning – a Hartford-based asset manager with over $140 billion AUM – issued its “State of the States” (SOTS) credit research…

BAML: SURGE IN PERSONAL INCOME TAXES NOT SUSTAINABLE

May 31, 2019 – Bank of America’s Phillip Fischer was of the view that the recent surge in income tax…

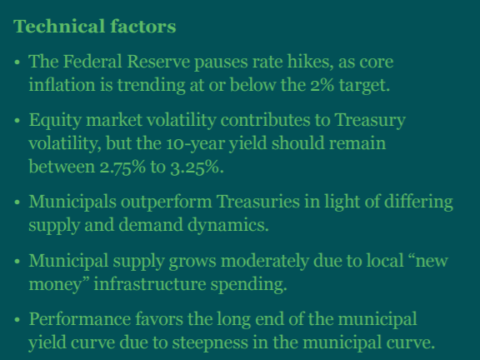

Nuveen: Munis to outperform Treasuries. Likes long end of curve.

Nuveen’s Q1 2019 report on municipal bonds was constructive on High Yield and long-end of the municipal curve. Expects Munis…